7 Trading Lessons from Wall Street’s Legendary “Stock Operator”

If you trade crypto, this will make you squirm

Almost a century after its publication in 1923, Reminiscences of a Stock Operator by Edwin Lefèvre remains a Wall Street classic.

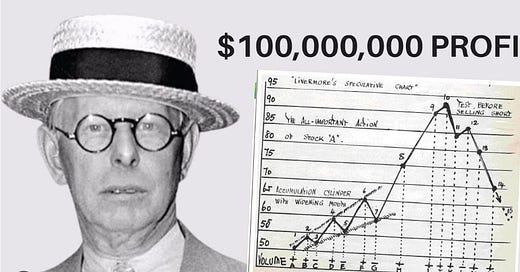

The book is a fictional account of the life of Wall Street speculator Jesse Livermore. Written in the first person, the story is entertaining, readable, and packed with investment wisdom. Each page bristles with insights into …