The Collapse of Bitcoin's Mendacious Messiah

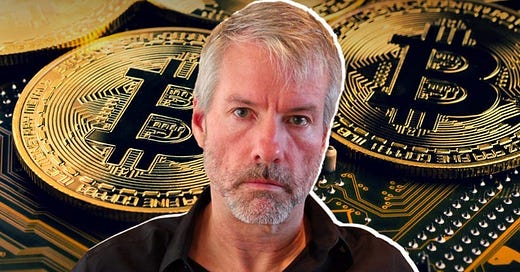

Every mania has its Icarus. Michael Saylor is that tragic figure for Bitcoin

Welcome to the 600+ Global Guru fans who have joined us in our first two weeks on substack.

Remember, it’s free.

Surely a bargain at twice the price!