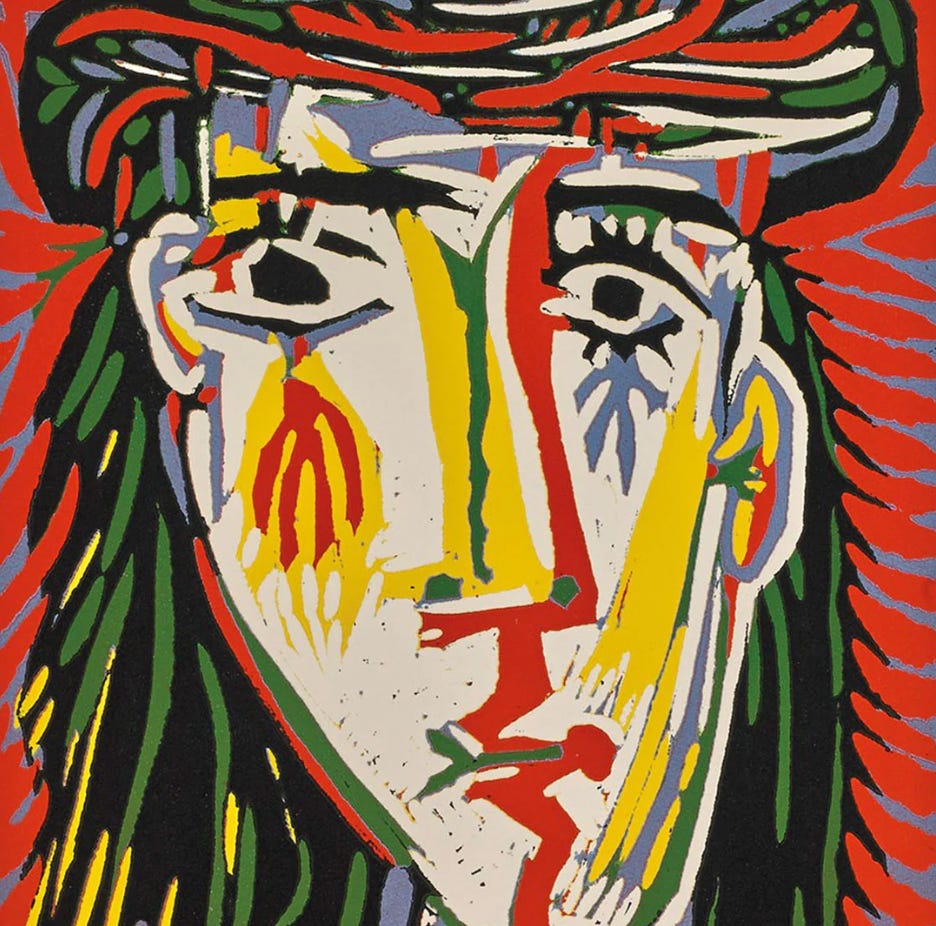

What the Value of a Single Picasso Can Teach You About Investing

You can look at a Picasso one of two ways.

If you’re a rank amateur, you think, “My kid could do the same thing.”

If you are one of the world's great art collectors, you instantly recognize it as a product of genius.

Or do you?

As it turns out, evaluating modern art can be as challenging as… well… identifying the next market-crushing stock.

It is possible to…