Note: This is a reprint of the article I originally published on December 3rd, 2022.

“The financial memory is very short.”

-John Kenneth Galbraith

Few newbie investors on Wall Street study history.

MBAs are too busy tracking Bill Ackman’s latest oracular utterances on CNBC.

Quant PhDs -operating in an ahistorical world of data mining-are still pretending homo sapiens are homo economicus.

And seat-of-the-pants amateur traders are still confusing brains with a bull market.

It’s only after 20 years that retired Wall Streeters get around to reading anything on Goldman Sachs’ recommended reading list.

That’s too bad.

History offers the most valuable lessons for successful investing.

And it’s not because it helps you pick the right investment.

It’s because knowing history can help you avoid expensive mistakes.

Take the case of Tesla (Nasdaq: TSLA)- the epicenter of our era's "Everything Bubble".

Tesla- More Typical Than You Think

You may be a Tesla fanboy. And you may believe, as some do, that Tesla stock is set to become a $10 trillion company.

But I have some bad news for you.

Yes, Tesla briefly attained the rarified heights of a trillion-dollar valuation.

Its market cap peaked at $1.23 trillion on November 3rd, 2021.

But after falling just over 50% in the past 13 months, Tesla will never see that market cap again.

You may believe Tesla is unique.

But to me, Tesla is just another example of an oft-told tale on Wall Street.

A stock with a story soars to remarkable heights.

Analysts project out current trends as far as their spreadsheets have columns.

The media lionizes -even canonizes- the company's CEO.

Fanboys dismiss naysayers as out-of-touch fogies who “don’t get it.”

But as sure as day turns to night, reality sets in.

Investors slowly awaken from their dopamine-induced delirium.

The stock comes crashing down.

And tens of thousands of acolytes are left nursing their investment wounds.

The same story repeats every Wall Street generation, with a different company….different hero… but with an almost identical plot line.

The Rise of Cisco Systems

Consider the fate of I.T. hardware, software, and networking equipment giant Cisco Systems (Nasdaq: CSCO).

Cisco Systems was founded in December 1984 by two Stanford computer scientists.

The husband-and-wife team had developed a technology that connected all computers on the Stanford campus – a novel idea at the time.

I recall trudging across the Stanford campus to a computer science building in the middle of the night to access computer time on LOTS-”low overhead time sharing.”

LOTS was likely using future Cisco technology.

Cisco went public in 1990 with a modest market cap of $224 million.

Fast-forward 10 years, and Cisco found itself at the intersection of several high-tech trends.

And the 1990s tech boom was in full swing.

Cisco became the go-to company for the picks and shovels in the internet gold rush.

By 2000, Cisco had become one of the hottest stocks on Wall Street.

Between the beginning of 1999 to March 2000, Cisco shares rose 236% to a market cap of $555 billion, or $80.06 per share.

Cisco surpassed Microsoft to become the most valuable company in the world.

Some analysts even predicted Cisco would become the world’s first trillion-dollar company.

Then came the dot-com bust.

Over the next two years, Cisco’s share price collapsed by 80% – wiping out $431 billion in shareholder value.

That's about $715 billion in today's dollars.

The Evolution of Cisco

Post-crash, Cisco picked itself up and went on an acquisition spree.

Cisco acquired Linksys and Scientific-Atlanta (companies that sold broadband networking technologies such as digital cable boxes and cable modems).

By 2007, Cisco claimed that half of internet-connected U.S. households used its Linksys or Scientific Atlanta products.

Cisco then pivoted toward videoconferencing, internet-based voice calls, and other Web 2.0 communications.

Cisco even acquired Pure Digital Technologies – the company behind the Flip Video camera.

But the rise of smartphones pulled the rug out from under Cisco’s strategy.

No matter how hard it tried, Cisco could not escape one harsh reality.

Cisco was a cutting-edge internet hardware company in the 1990s.

But that hardware had become a commodity and generated little profit.

And today, Cisco derives much of its revenue from software and services.

The Fate of Cisco’s Share Price

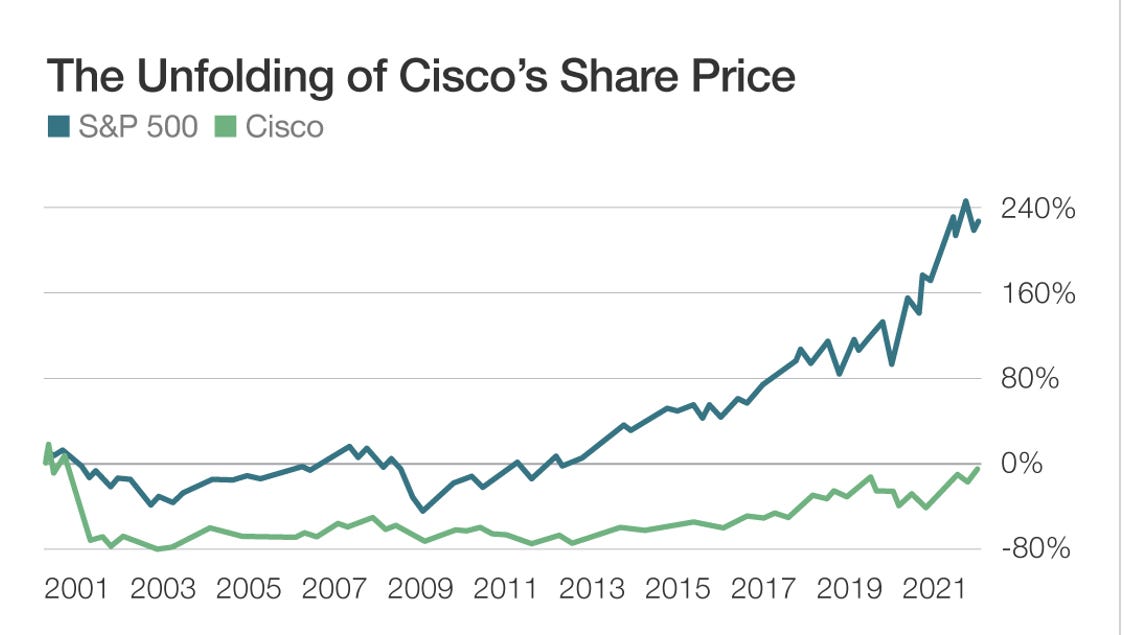

Cisco’s share price performance offers several important lessons.

In many ways, investors were right about Cisco.

For all the pivoting of its business model, over the last 21 years, Cisco’s revenues have grown fourfold to $49 billion.

Profits soared 5X to $11 billion.

But Cisco’s share price in 2000 was simply too high.

At Cisco’s March 2000 peak, its price-to-earnings (P/E) ratio stood at an astonishing 201.

Fast forward 22 years, and Cisco's stock price has yet to recover.

Today, Cisco’s shares trade at $49, still almost 40% below their all-time high.

And they have lagged the S&P 500 by more than 220% since their dot-com peak.

Valuation Matters

So what does all this mean for Tesla?

At its peak, Tesla was among the most overvalued stocks ever in investing history.

In 2021, when it sold fewer than one million cars, Tesla boasted a P/E ratio of 332.

Its market cap exceeded the collective value of the world's next ten automakers.

Remarkably, the Cathie Woods and Ron Barons of the world remain all in on Tesla.

Woods’ price target on Tesla is $1530. Baron has a stunning 45% of one of his largest funds invested in Tesla stock.

And neither is a Wall Street spring chicken.

For me, the unraveling of the Tesla saga is inevitable.

Yes, like Cisco, Tesla may survive.

But its primary offering- electric vehicles- is destined to be commoditized, much like Cisco’s offerings.

Even if Tesla pivots successfully to software, its sky-high valuation condemns the stock to dead money over the next decade.

The bottom line?

John Kenneth Galbraith was right.

The financial memory is very short.

I’m here to remind you that it can also turn out to be very expensive.

So heed the lessons of history- and Cisco.

Dump your Tesla stock.

Thanks for reading The Global Guru. This post is public, so please share it with anyone who would love- or hate - it.

Follow me on Twitter where I now post daily @NickVardy

© 2022 Vardy Publications LLC, 1621 Central Avenue, Cheyenne, Wyoming, 82001

All Rights Reserved.

Any reproduction, copying, or distribution, in whole or in part, is prohibited without permission from the publisher. Information contained herein is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal circumstances–we are not financial advisors and do not give personalized financial advice. The opinions expressed here are those of the publisher and are subject to change without notice. It may become outdated, and there is no obligation to update any such information.

Investments should be made only after consulting with your financial advisor and only after reviewing the prospectus or financial statements of the company or companies in question. You shouldn’t make any decision based solely on what you read here. Neither Vardy Publications LLC nor its employees and writers receive any compensation for securities or investments covered herein.

https://nicholasvardy.substack.com/p/nvidia-what-were-you-thinking-be

In the 1990s, Silicon Valley company SUN Microsystems was a Wall Street darling.

At one point during the 2000 dotcom bubble, SUN’s stock price soared to $64 before crashing back to $10. SUN CEO Scott McNealy later chided investors who had bought SUN shares at its peak.

"At ten times revenues, to give you a 10-year payback, I have to pay you 100 percent of revenues for ten straight years in dividends," he said. "That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard for a company with 39,000 employees. . . assumes I pay no taxes. . . [and] assumes that with zero R&D for the next ten years, I can maintain the current revenue run rate.

“What were you thinking?” asked McNealy.

TESLA trades at almost 11x sales today- higher than SUN when McNealy made these comments.

Ford and GM trade at 0.33 sales- 1/30th the valuation of TSLA

You say there's a chance... Maybe. But there are far better and cheaper options out there. NVDIA at 40x (!!!) sales is not one of them.

Always enjoy the insight in your write ups. I’m going to disagree with one point- I think Tesla’s value is in the charging network and not the cars. Second, the Toyota battery story may be a game changer.